CASH RICH Companies

Cash is King as most people have heard. Is the saying true for today's context? Perhaps you may think cash is bad as it inhibits our investment opportunity.

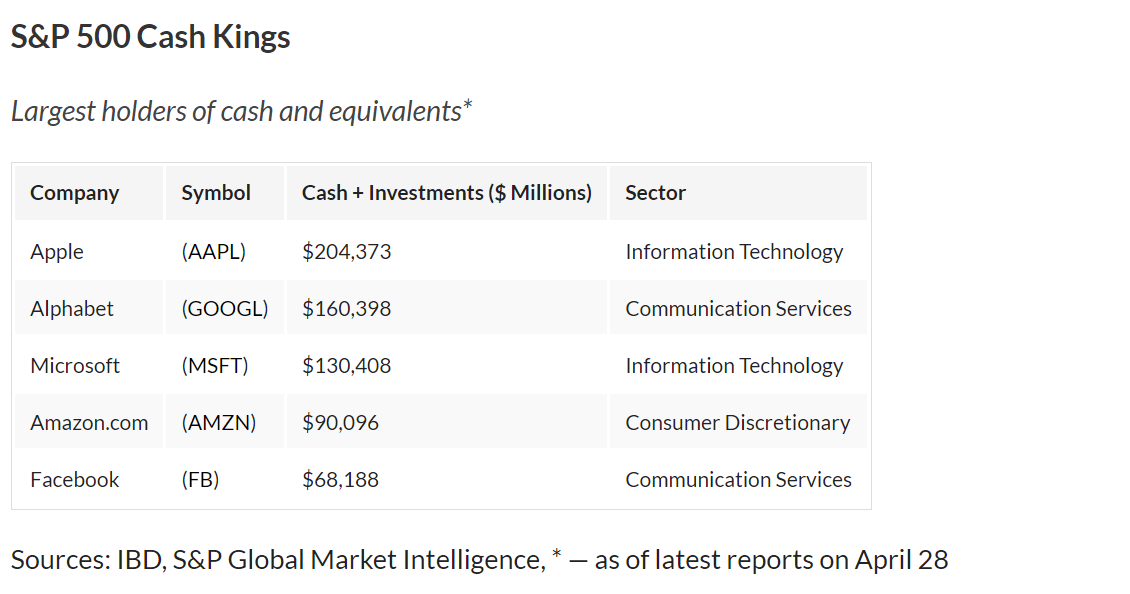

Looking at the table below from IBD and S&P Global Market Intelligence, it seems that Apple which is not only one of the largest market capitalization company, it also has one of the largest cash hoard for a company in the world and also one of the most profitable companies also borrows money. With all these 3 ticks, why would a company like Apple still borrow from the Bond Market.

The question should not be what does Apple do with the money that it borrows? It can be a variety of reason as to fund its Research and Development (R&D), marketing, expansion, etc. The key question is why? The reason for borrowing cash is because borrowing cost is low and it makes sense. Savvy Companies and individuals continue to subscribe this theory and continue to tap the bond market for its favorable low interest environment.

Can individuals adopt Apple investment strategy? Is it even possible? Of course, one can say that Apple has leverage and everyone would want to have a piece of Apple bonds as it is practically risk free. On the same token, some Governments adopt the same strategy of tapping on the Bond market.

Can we follow the MNCs as individuals and have our cake and eat it at the same time? Most people don't think so. I believe it is possible but definitely not of the same scale. Look at some of the wealth people around the world who adopt the same strategy.

Perhaps the investments in the stock market and the property market would be a great start on the areas that individuals can place their additional cash.

Some Asset enhancing strategies to consider:

The owner can choose to unlock their hidden HDB / Private property value by selling it and purchasing 2 condos, 1 for home stay (liability) and the other condo (asset) to be used as an investment to rent out and collect rent. Even if the rental is just enough to pay for the bank loan and quarterly maintenance for the upkeep of the estate, the price of condos will appreciate over time due to land scare Singapore.

The key is to borrow cash by taking up a loan and not fully pay for their house and use the excess case to purchase another property or purchase some stocks.

This will be covered in more detail in another article.