Cooling Measures. Prices Drop. Wait or Buy Now?

In an article dated November 17, 2021, we expressed skepticism about the imminent implementation of Cooling Measures. While we anticipated the government would introduce Additional Buyer Stamp Duty (ABSD), we were surprised by the speed of its enactment.

Analysis of 2021 Cooling Measures and Their Impact on Prices

The increase in ABSD for foreigners and multiple property owners is unlikely to have a significant effect, as demand for owner-occupied homes remains robust. Most developers have already sold the majority of their units and are not under pressure to lower prices due to limited market supply. Historically, during the last cooling measure on July 5, 2018, when the government raised the ABSD, property prices did not decline. Therefore, based on past trends, the measures introduced on December 5, 2021, are not expected to substantially impact developer pricing.

Regarding the Total Debt Servicing Ratio (TDSR), which has been reduced from 60% to 55%, this change is primarily aimed at preventing over-leveraging and is unlikely to disrupt purchasing plans significantly.

Additionally, global air travel is gradually resuming, leading to an uptick in foreign buying activity. Increased wealth from financial markets is driving demand in Singapore’s property sector, which remains one of the safest places for real estate investment. As people return to work, job markets are expected to stabilize.

The Ministry of National Development (MND) has reiterated that our mortgage-to-income ratio is still well below historical averages, indicating that demand for homes will persist.

Comparing with Previous Cooling Measures

Unlike the initial introduction of ABSD and TDSR in 2013—which heavily impacted a speculative market—this recent tightening is more akin to the measures of 2018. The latter did not lead to significant price reductions, as developers maintained their pricing strategies.

Why Invest Now?

A prime example is Martin Modern, which launched on July 22, just two weeks after the July 5 cooling measures. Buyers who purchased in 2018 paid $600-$700 per square foot more than current prices.

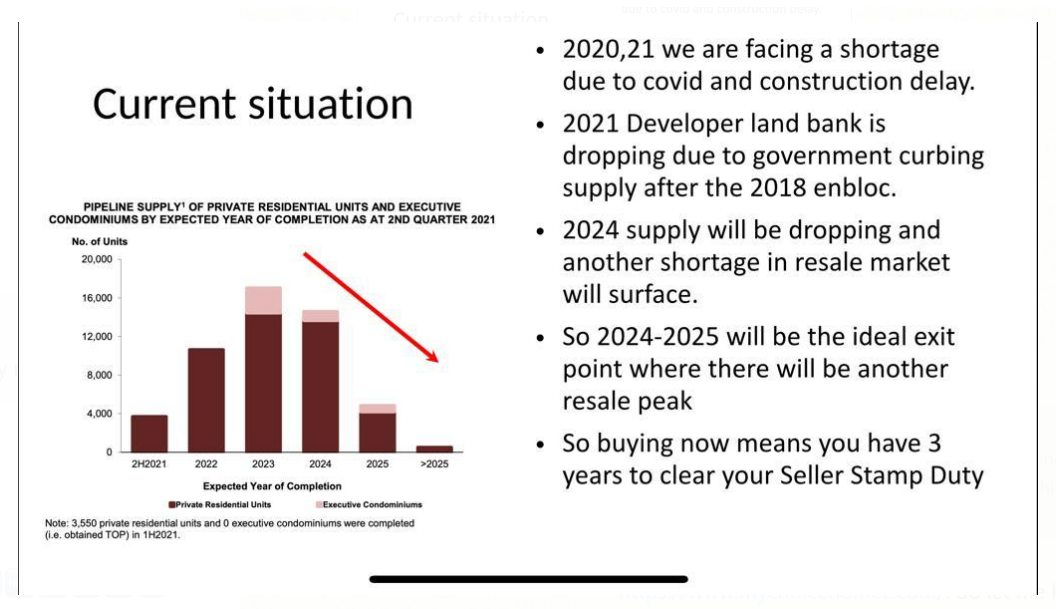

I believe this is an opportune time to secure desirable units at reasonable prices before the market adjusts to the new ABSD rates and potentially triggers another bullish trend. Investors should also consider taking advantage of the three-year Seller Stamp Duty (SSD) period to maximize their returns by targeting the resale market peak anticipated in 2025.

In conclusion, with fewer new homes expected to be completed by then, waiting too long to purchase may result in being subject to SSD when resale prices peak in 2024-2025.