Made money from your EC. What's Next?

Amore Executive Condo (EC)

In 2016, Joe & Mary made the decision to secure their desired Executive Condo (EC) Amore by placing a deposit at a price range of $750 to $800 per square foot. Although the cost appeared high initially, the property's proximity to their parents' residence and their parents' willingness to provide assistance in caring for their upcoming baby influenced their choice to proceed with the purchase.

After enduring 2 1/2 to 3 years of construction, Joe & Mary were overjoyed to finally receive the keys to their Amore EC from the Developer. Following the Minimum Occupation Period (MOP) of 5 years at Amore EC, they made the decision to transition to a private condo after assessing their circumstances.

Within just 5 years, the value of Amore EC had escalated from $750 per square foot to approximately $1000 per square foot. Assuming Joe & Mary's apartment size is 100 square feet, their paper profit amounted to $250,000, reflecting a significant gain of around $50,000.

Reflecting on 2012 Executive Condo Articles:

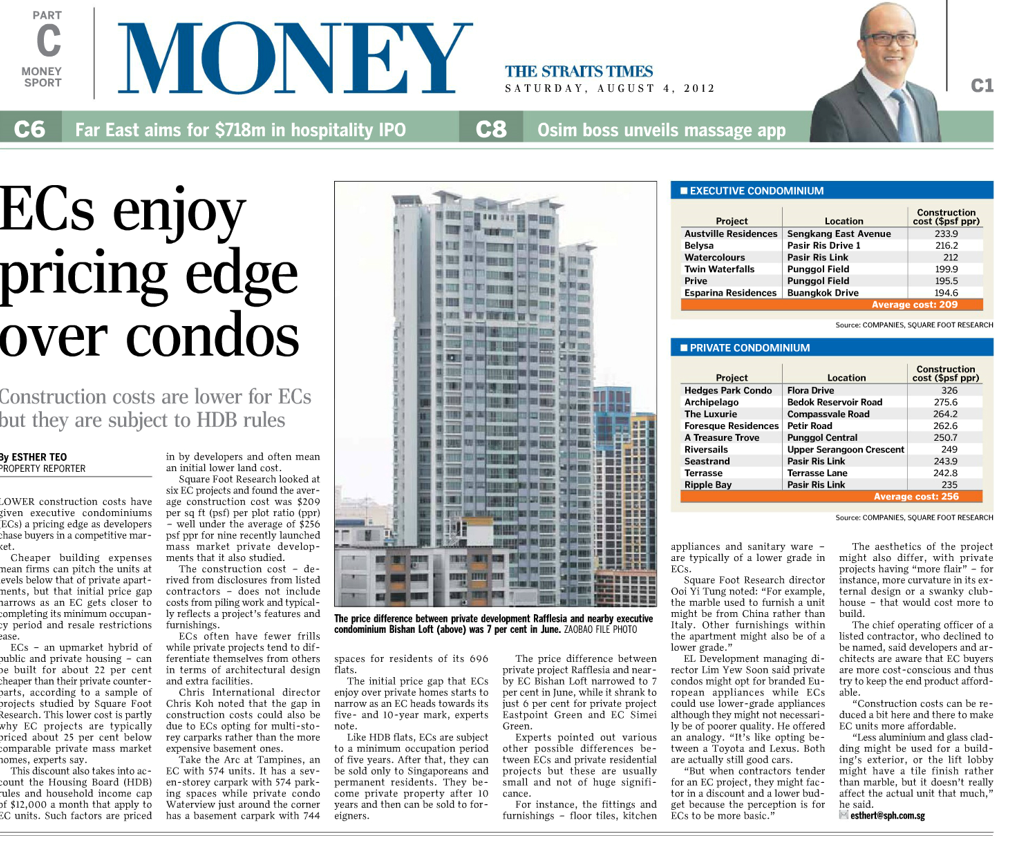

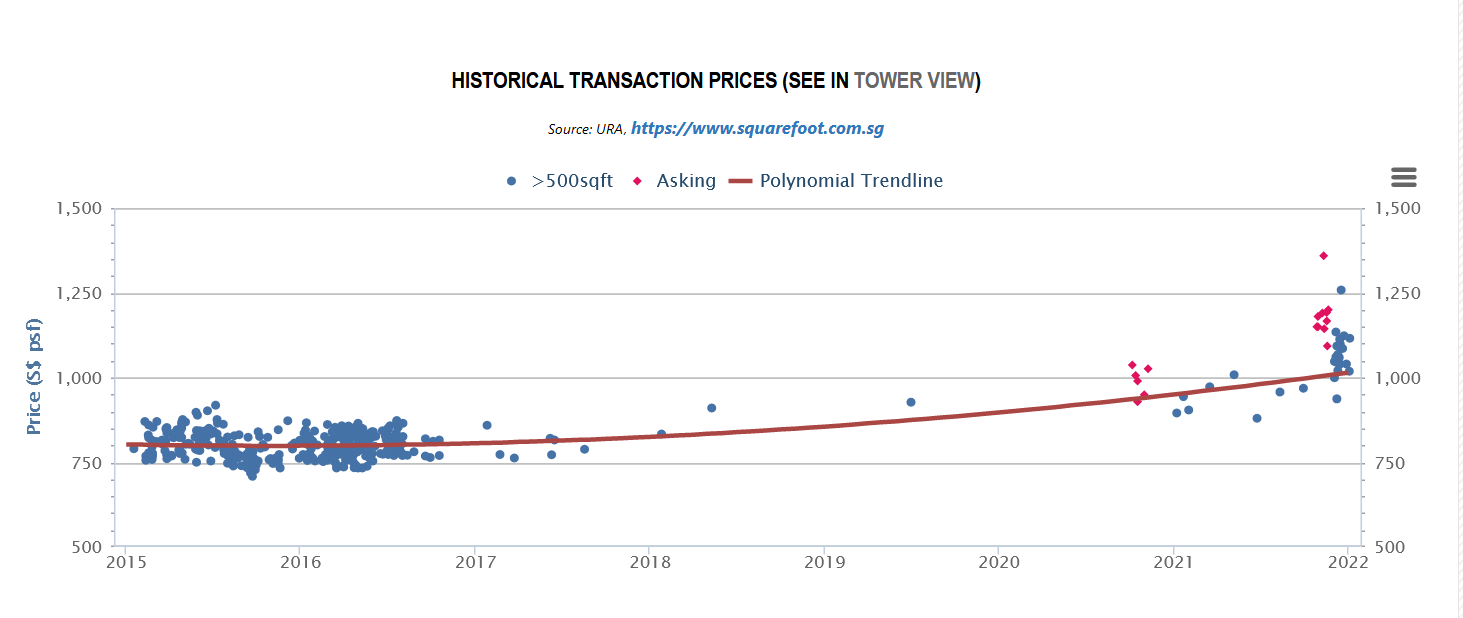

Reviewing articles from 2012 reveals the price appreciation trends of Executive Condominiums (ECs), as depicted in Chart 1 from The Straits Times article.

Exploring Bishan Loft Executive Condo as an Example:

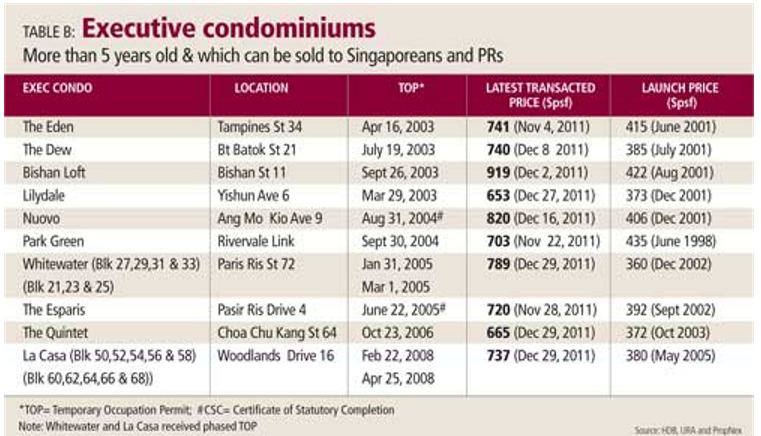

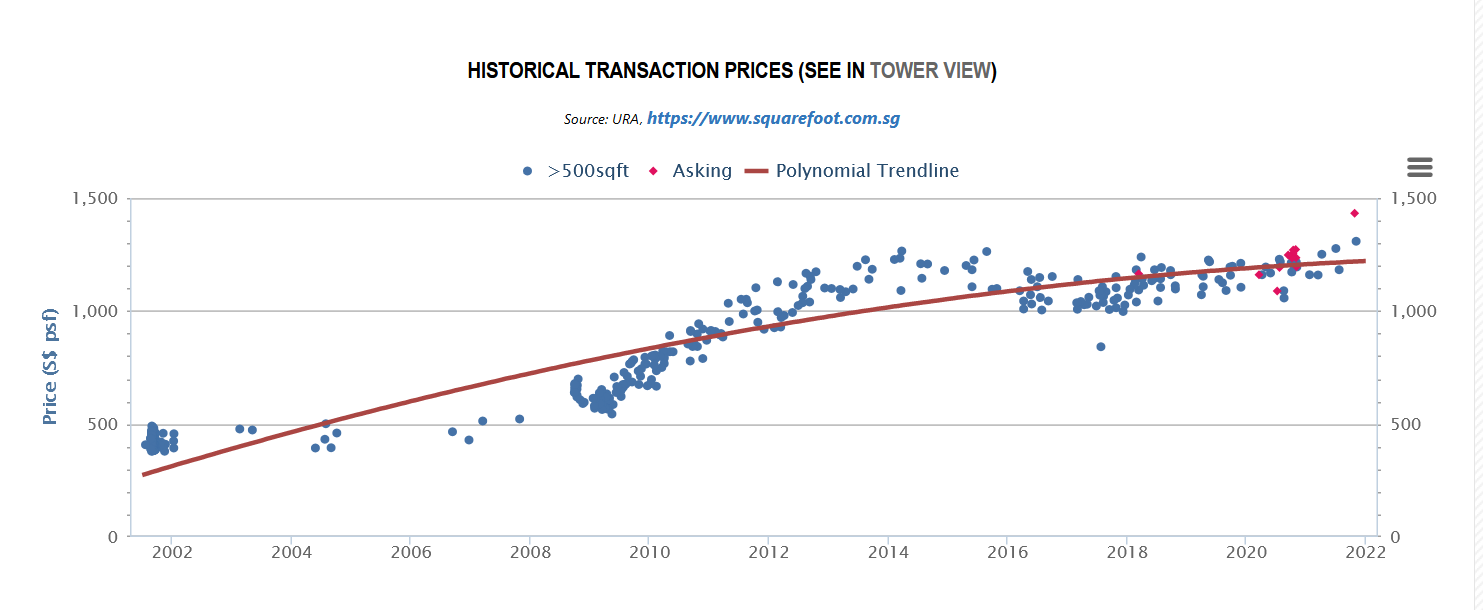

Analysing data from Squarefoot showcases the evolution of Bishan Loft's average Price Per Square Foot (PSF) over a decade. Starting at an average of $400 to $500 PSF in 2000 (Chart 2), it surged to around $1300 PSF (Chart 3), marking a nearly threefold price increase. While historical trends provide insights, past performance does not guarantee future outcomes.

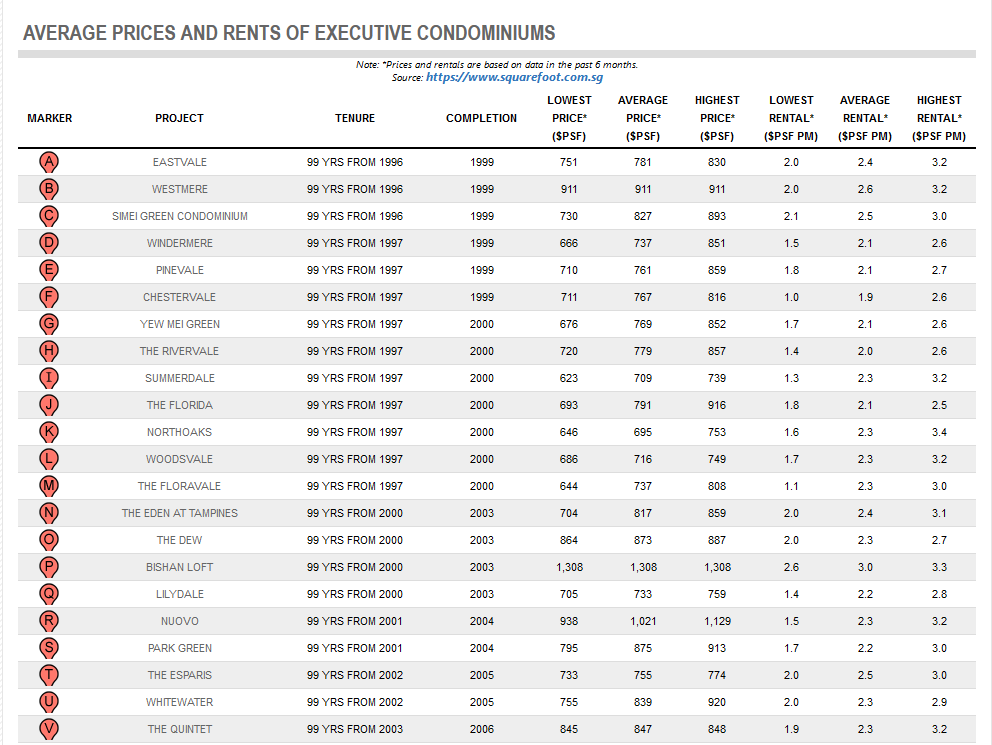

If you look at Chart 4, you will realise that there is no way EC prices are going back to 2002 prices which is a 3 times drop based on today's pricing.

Our Suggestion

Now that you have accumulated substantial paper profits, what should be your next step? Our recommendation is to capitalize on your gains by selling your Executive Condo (EC) and reinvesting the profits in a new condominium. While this strategy may seem straightforward, it entails complexities that require careful consideration.

Why do we advocate for selling your EC and purchasing a new condo? When you invest in a new condominium, you are essentially investing in its future value. Reflect on your initial concerns about the high EC prices when you made your first purchase. Consider the current EC prices. Present property sales data indicates that the Outside Core Region (OCR) and Rest of Core Region are thriving markets, making them favorable locations for investment.

By strategically managing your finances and liquidating your EC, you have the opportunity to expand your asset portfolio and potentially acquire ownership of two private properties.

Articles from 2012 for your reading pleasure