Comparison of Seaside Residences and Mandarin Gardens

Overview

Seaside Residences and Mandarin Gardens are two prominent residential developments located in Bedok, District 15, Singapore. While Seaside Residences is a new launch completed in 2021, Mandarin Gardens is an established resale property completed in 1986.

Seaside Residences

- Type: Leasehold condominium (99 years)

- Completion Year: 2021

- Total Units: 843

- Sale Price Range: S$1.05M - S$3.28M (approximately S$1,928 - S$3,618 psf)

- Rental Price Range: S$3,200 - S$8,500 per month

- Facilities: Includes a gym, lap pool, tennis court, BBQ area, and more.

- Location: 18 Siglap Link, near Siglap MRT (4 min walk)

- Developer: Frasers Property Singapore

- Unique Features: Offers modern amenities and unblocked sea views, making it attractive for buyers seeking new developments near the coast[1][4][9].

Mandarin Gardens

- Type: Leasehold condominium (99 years from 1982)

- Completion Year: 1986

- Total Units: 1,006

- Sale Price Range: S$1.06M - S$3.4M (approximately S$1,175 - S$1,690 psf)

- Rental Price Range: S$3,300 - S$9,000 per month

- Facilities: Offers a swimming pool, gym, BBQ area, and security.

- Location: 3 Siglap Road, accessible via Laguna Park and Marine Terrace MRT stations.

- Developer: Mandarin Gardens Pte Ltd

- Market Positioning: Attracts buyers due to its larger unit sizes and established community despite being older than Seaside Residences[2][5][6].

Key Comparisons

| Feature | Seaside Residences | Mandarin Gardens |

|---|---|---|

| Completion Year | 2021 | 1986 |

| Total Units | 843 | 1,006 |

| Sale Price Range | S$1.05M - S$3.28M | S$1.06M - S$3.4M |

| Rental Price Range | S$3,200 - S$8,500 | S$3,300 - S$9,000 |

| Facilities | Modern amenities with sea views | Established facilities |

| Average Sale Price psf | Approx. S$2,500 | Approx. S$1,303 |

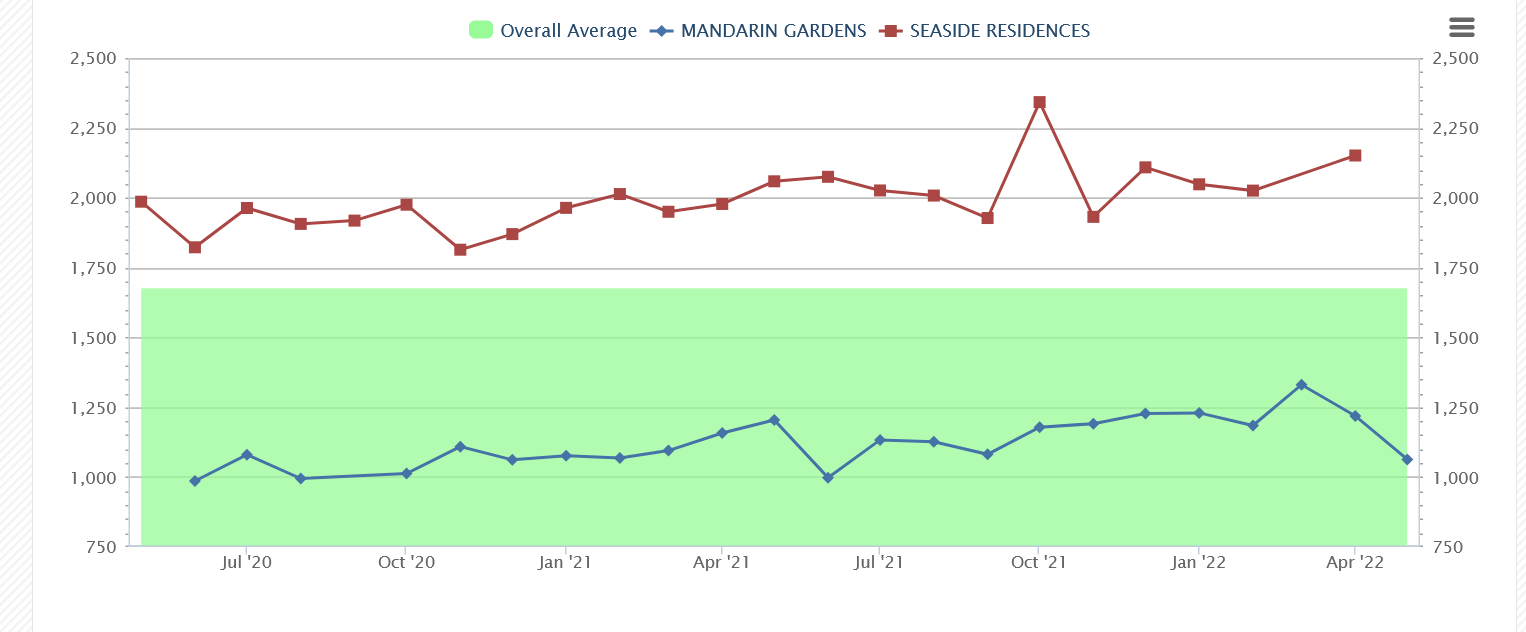

What considerations do buyers have when purchasing a unit at Mandarin Gardens? Many may assume that its lower price will result in better returns. However, this belief often turns out to be misguided. After two years, Seaside Residences clearly outperformed Mandarin Gardens in terms of PSF (Per Square Foot) appreciation, demonstrating a superior ROI (Return on Investment).

Charts indicate that the PSF for Mandarin Gardens, an older condo with en bloc potential, has lost its appeal, while Seaside Residences, a new launch, has not only maintained its pricing but has also seen an increase in value. The average PSF in the Pine Grove region ranges from $1,000 to $1,350, which is considered relatively affordable compared to the broader property market. For reference, the PSF for an Executive Condominium (EC) in Yishun is around $1,350. This raises the question for investors: "Does the lower pricing lead to better ROI?"

One factor contributing to the higher PSF at Seaside Residences could be the smaller unit sizes, making the overall cost more manageable compared to units at Mandarin Gardens. Ultimately, it comes down to affordability; if buyers feel they are acquiring an affordable unit, they are likely to proceed with their purchase.

Looking back at July 2020, the PSF for Seaside Residences was in the range of $1,700 to $2,000. At that time, some might have viewed buyers of this new launch as making unwise investment decisions. Fast forward two years to 2022, and those who invested in Seaside Residences are now enjoying significant profits.

For example, if a buyer purchased a unit at Mandarin Gardens for $1,000 psf in 2020, its current price is approximately $1,000 to $1,100—an increase of just $100 psf. In contrast, a unit at Seaside Residences bought at an average of $2,000 psf is now valued around $2,200 psf, resulting in a paper profit of $200 psf.

To illustrate this further: assuming a unit size of 500 sqft and a net gain of $200 psf, this would yield a theoretical paper profit of $$500 \text{ sqft} \times $200 \text{ psf} = $100,000$$.

In summary, Seaside Residences offers a contemporary living experience with modern amenities and proximity to the sea, whereas Mandarin Gardens provides a well-established community with larger unit options at potentially lower price points per square foot. This makes each development appealing to different segments of the market based on preferences for new versus established properties.