Pine Grove (GLS) vs Pine Grove (Enbloc Potential)

GLS @ Pine Grove to set Pine Grove Area Prices Roaring

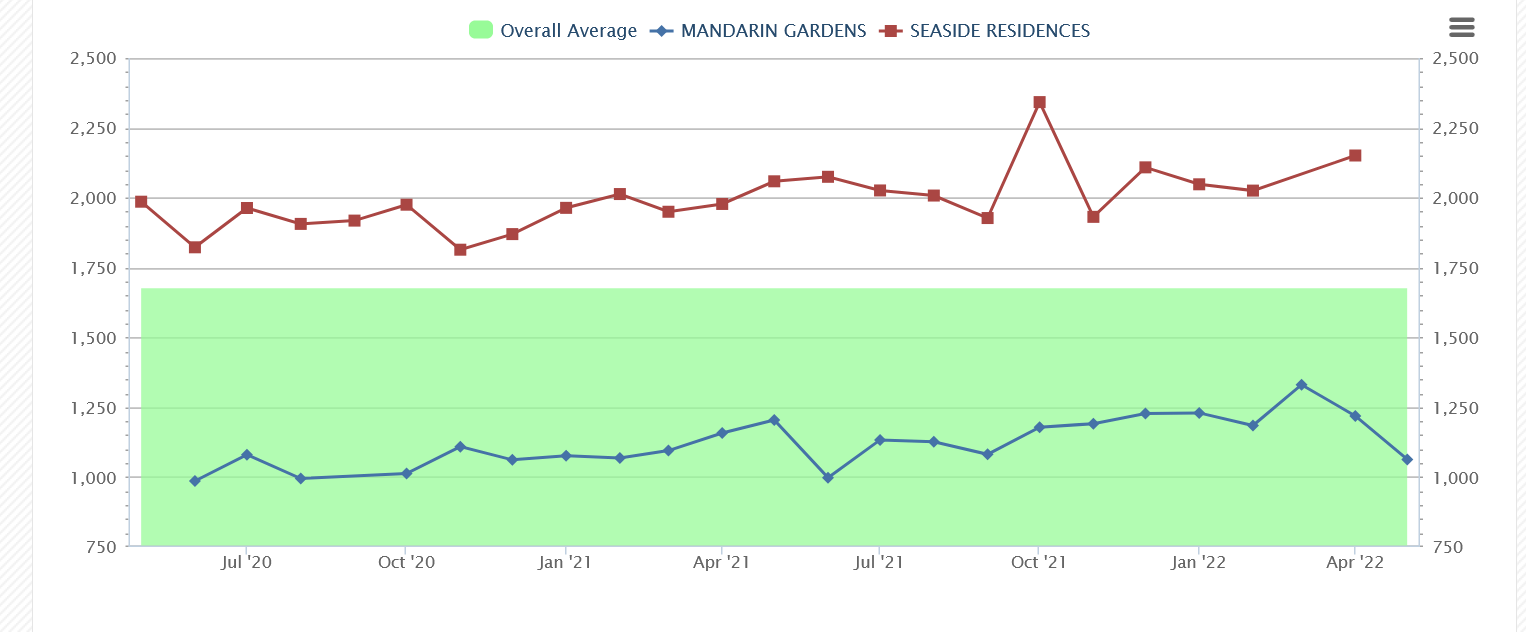

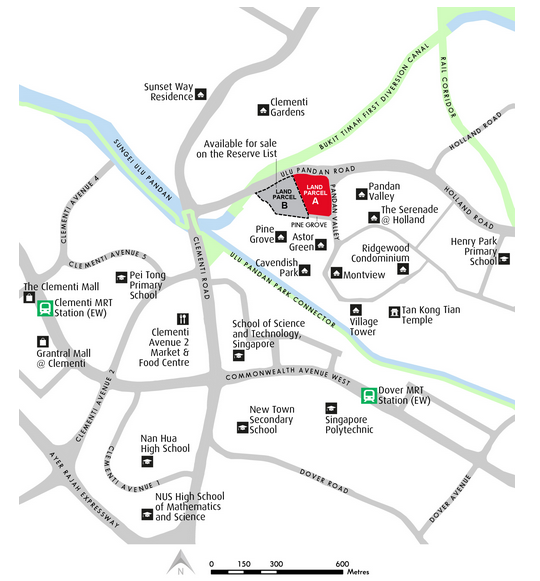

The Pine Grove area is poised for significant growth, driven not only by the potential en bloc sale of Pine Grove Condo but also by the availability of two land sites, Parcels A & B, offered under the Government Land Sales (GLS) Program. The URA's decision to offer these two GLS sites reflects the government's confidence in the region. While buyers may have initially invested in Mandarin Gardens with high expectations, the outcome favored Seaside Residences in the end. This scenario raises the question of whether history will repeat itself in Pine Grove, with one development outperforming the other in terms of results and returns.

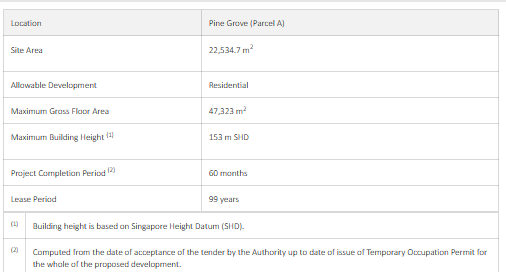

The Pine Grove (Parcel B) GLS site received a top bid of $692.4 million, equating to $1,223 psf ppr, from an MCL Land-linked entity in November 202314. This site spans 25,039 sq m, has a GFA of 52,583 sq m, and can yield 565 residential units4. Additionally, the adjacent Pine Grove (Parcel A) site was sold in 2022 to a joint venture between UOL Group and Singapore Land Group for $671.5 million, or $1,318 per sq ft per plot ratio (psf ppr)45.

# Episode 1: CLASH of TITANS - NEW (Seaside Residences) vs RESALE (Mandarin Gardens)

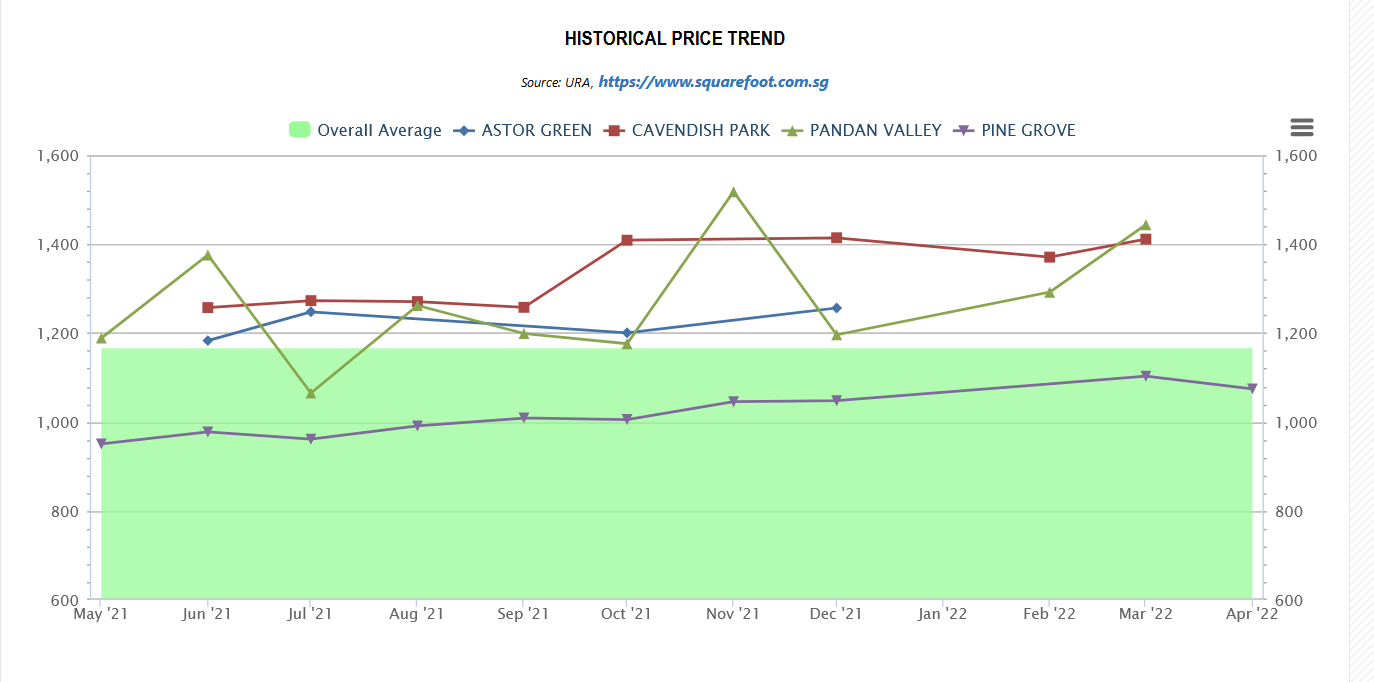

From this chart below, it seems that the Pine Grove Chart has peaked.

We can see from the chart that the number of units sold in Pine Grove is also one of the highest due to the fact it is also one of the largest condo in that area.

Price Pine Grove Area set to

Pine Grove Condo, originally built as a HUDC estate in the 1970s and 1980s, underwent privatization in 1996, transforming into a condominium development with 660 units[2][4][5]. Despite several unsuccessful attempts at en bloc sales, Pine Grove remains a significant property in a spacious land area with beautiful surroundings, typical of HUDC developments from that era. The size of the land and the property itself, like many HUDCs of its time, was considered substantial back then but is now notably large by contemporary standards[4][5].

The Pine Grove condominium in Singapore has faced challenges in its en bloc sale attempts. Despite multiple efforts, including lowering the reserve price to S$1.78 billion in the fifth attempt, success has been elusive. Developers have shown a preference for smaller- to medium-sized collective sales sites due to current market challenges and cooling measures235. The failed attempts reflect a broader trend where some properties have struggled to secure en bloc deals, with many sites revisiting sales after adjusting prices4. Pine Grove's situation highlights the complexities and uncertainties surrounding en bloc sales in Singapore's property market.

Gentle Reminder - Points to consider when choosing the Property to purchase

- What is your Budget?

- What is your Timeline ? When do you need to move in?

- Are you currently renting ? If yes, how much is your monthly rental?

- Are you paying for your house rental or you yoo

- Does your new home need to be near your child's school?

- How much do you want to spend on renovation?