How can you benefit from Ang Mo Kio Ave 1 New Condo launch ?

There are 2 ways for Developers to replenish their land bank. One way is to purchase land via Government Land Sales (GLS) and the other method is via enbloc sale of land from private home owners.

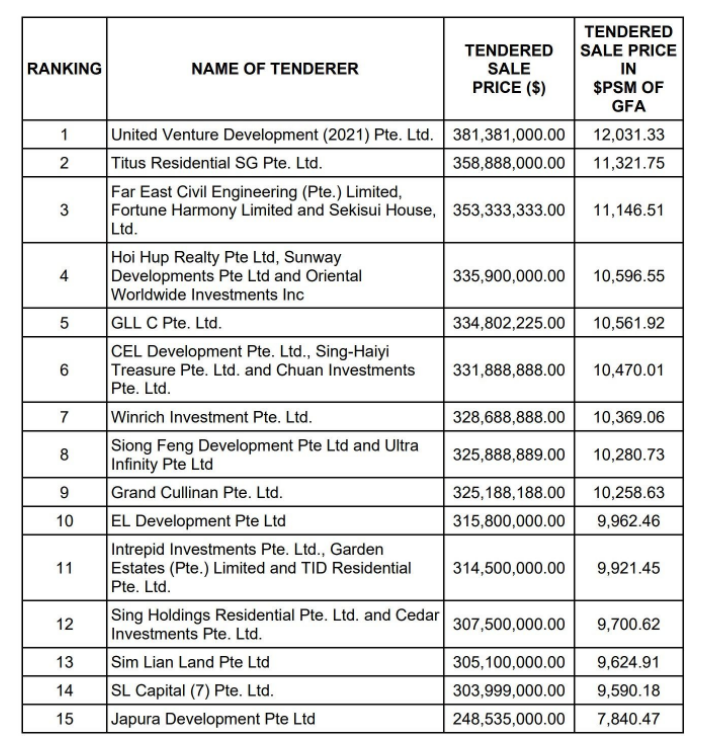

The GLS is a public tender process whereby the Government sells the state land to the interested Developers. Interested Developers. putting up their bids via a public tender whereas the Enbloc process is more of a private affair between the potential suitor i.e. The Developer and the home owners.

The GLS gives the public and the Government an indication of how "hot" the property market is based on the number of bids and how close the bids are to each other. In this GLS there are 15 bidders which implies that Developers are very keen on this land based on macro-economics and local demand -

If one was to look at only the GLS market, one would not be wrong to think that there is no Covid-19 economy. Is that true? I have spoken about this topic before and I think that it is indeed worth exploring further.

This is the site that we will be talking about. Drawing a bid from UVD (United Development Ventures) which is joint venture between UOL Group, Singapore Land Group and Kheong Leong Company. From their top bid at $381.38 million, it translates to $1,118 per per square foot per plot ratio.

What does this GLS pricing mean for you, the investor or rather the future home owner? It means regardless of whether you like it or not, prices are going up. Not to mention the fact that construction cost has been creeping northwards.

It is very strange that when prices of stocks and properties are headed southwards, no one wants to touch it. Imagine your favourite phone which cost $1500 has a discount of 20% and it is a legit discount. This means the phone which you have the phone you so wanted now cost $1200.

Imagine if the condo that you are eyeing which costs $1500 psf and meets all your criteria. Now there is a discount of $300 psf. Interesting, the buyers will stay away citing all sorts of reasons for it. The same story is for the stock market. For example, everyone knows Apple is a $2 Trillion Market Cap company $2.08 trillion as of March 15, 2021 and cash and investments of $204 billion as of Apr 2021. If Apple stock goes southwards from $150 to $130. Buyers would run away as they would not want to catch a falling knife.