Is Jadscape still a good buy?

As of January 11, 2025, the question of whether Jadscape is a worthwhile investment following its Temporary Occupation Permit (TOP) hinges on several factors influencing the Singapore property market. Here’s an analysis of the current landscape and what potential buyers should consider.

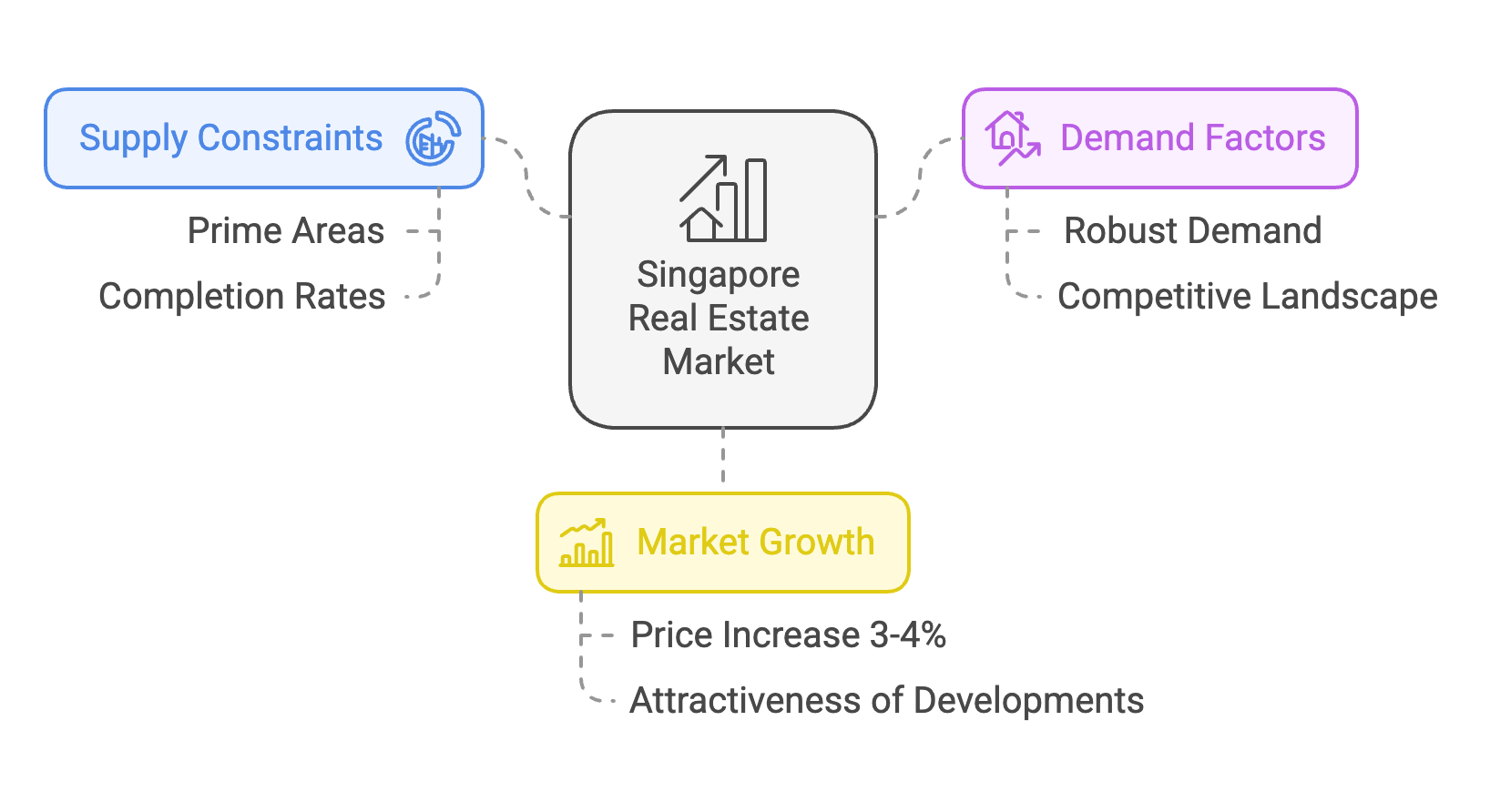

Market Overview

The Singapore real estate market is projected to experience moderate growth in 2025, with private home prices expected to rise by approximately 3% to 4% due to constrained supply and robust demand. The anticipated completion of only about 5,348 private home units this year represents a significant decline from previous years, intensifying competition for available properties. This supply shortage is particularly pronounced in prime areas, which may enhance the attractiveness of developments like Jadscape.

Interest Rates and Economic Factors

Recent trends indicate a decline in home loan interest rates, which could further stimulate buyer interest and affordability in the market. As the Monetary Authority of Singapore predicts steady economic growth between 2% and 3% for 2025, buyer confidence is likely to strengthen, particularly among high-income individuals and expatriates. This economic backdrop makes it an opportune time for potential investors to consider properties like Jadscape.

Demand Dynamics

The demand for both new and resale properties remains strong. With many buyers looking to upgrade or enter the market, the resale segment is expected to thrive. Additionally, lower interest rates are likely to encourage first-time homebuyers and those looking to upgrade their living situations]. Given that Jadscape offers modern amenities and a desirable location, it could attract buyers who are priced out of newer launches.

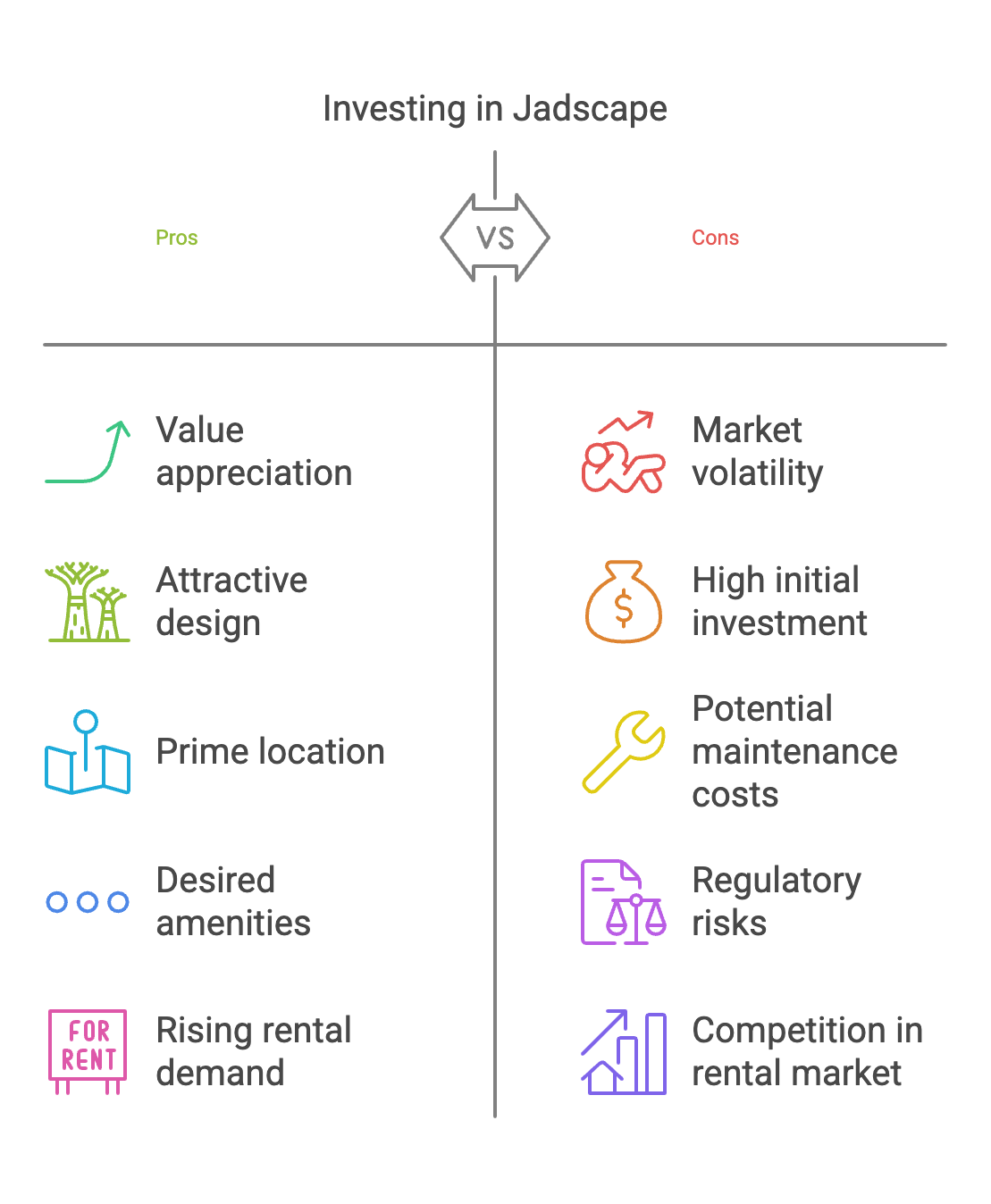

Investment Potential

Investing in Jadscape post-TOP could be a strategic move due to its potential for appreciation in value. The property’s appeal lies in its design, location, and the amenities it offers, which align with current buyer preferences. Furthermore, as rental demand continues to rise—especially in prime areas—Jadscape could also serve as a lucrative investment for those looking to benefit from rental yields.

Conclusion

In conclusion, purchasing a unit in Jadscape after its TOP appears promising given the current property market dynamics in Singapore. With rising prices, favorable economic conditions, and strong demand for residential properties, investors may find that Jadscape represents a valuable opportunity. However, prospective buyers should conduct thorough research and consider their financial situations before making any commitments.