Lentor Central Residence: Debut GLS Launch in Lentor. Is it a Smart Investment?

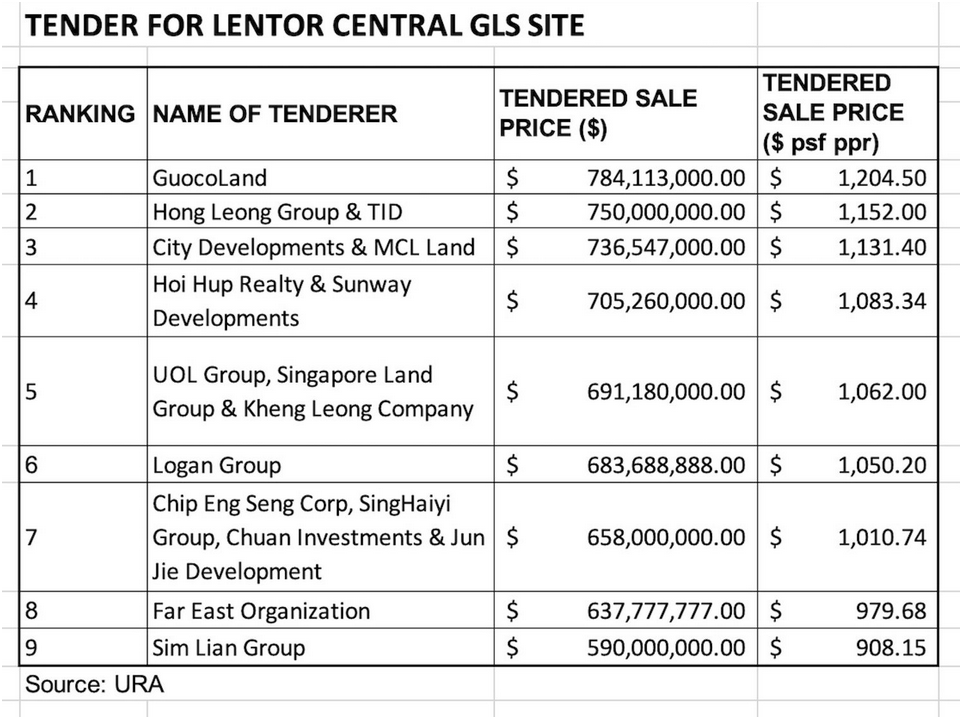

Perceptions of Lentor Area are Changing: From Obscurity to Prominence. Guccoland Secures Highly Anticipated Lentor Central GLS Site. What's Next?

Lentor Central Residences

Read about which is a better purchase - Resale vs New or is it New Launch vs Resale

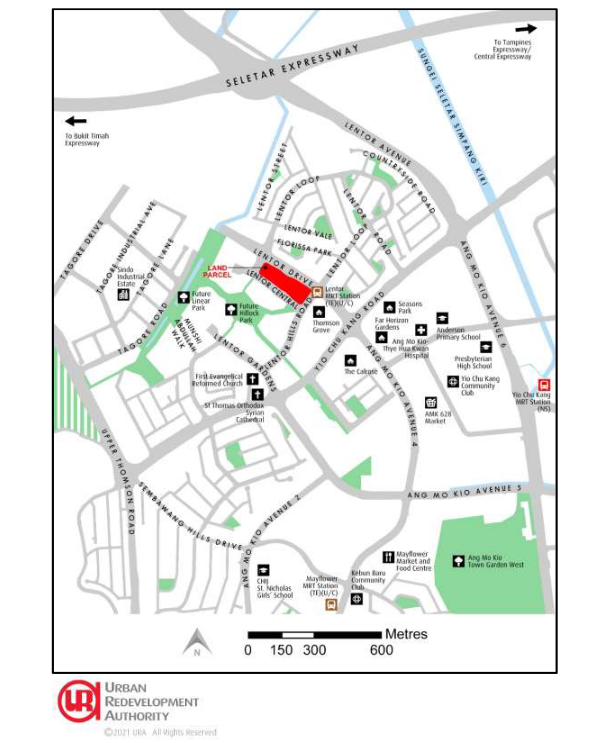

Included the URA-provided Location Map of Lentor Central Land Site, Situated Near Nature Reserves, Seletar Expressway, and Vibrant Dining Spots along Upper Thomson Road.

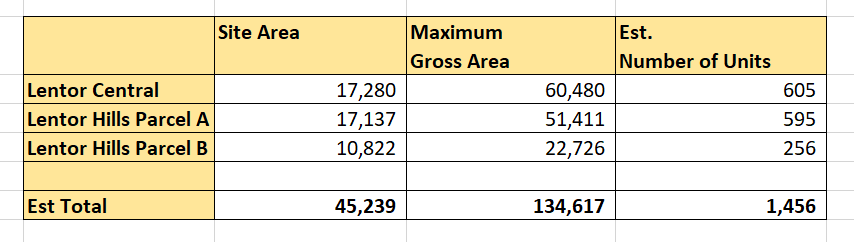

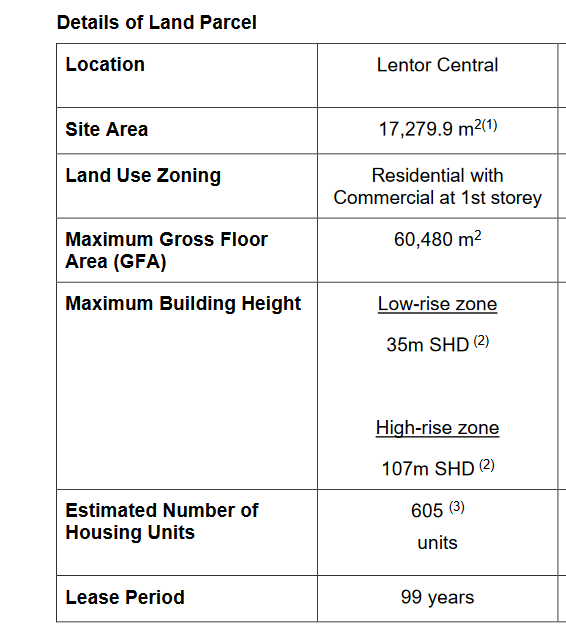

"Tabulated Overview: Lentor Central Site's Expansive Size and Potential Unit Count. Early Sales Indicate Price Advantage, Following Past Trends.

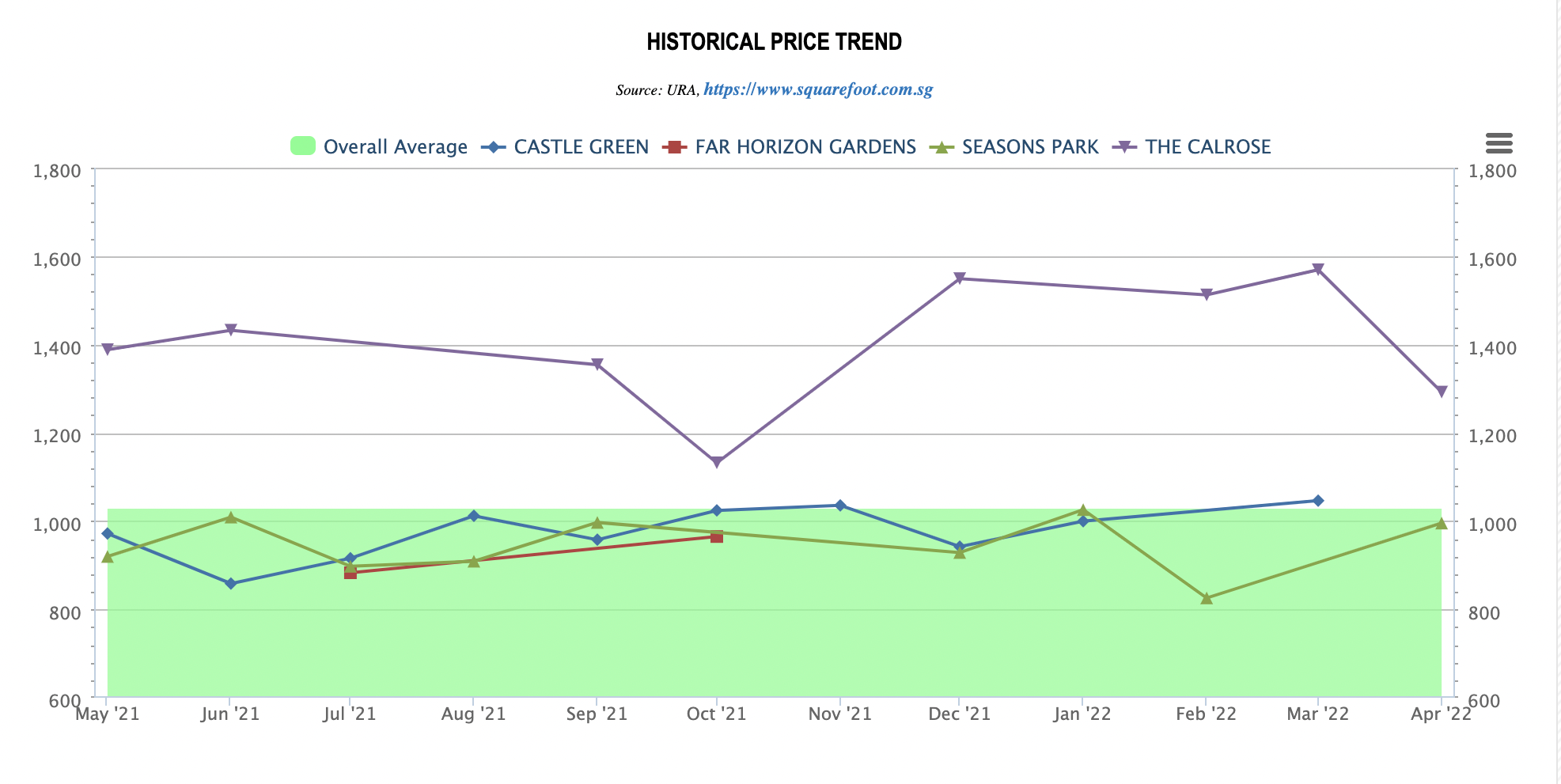

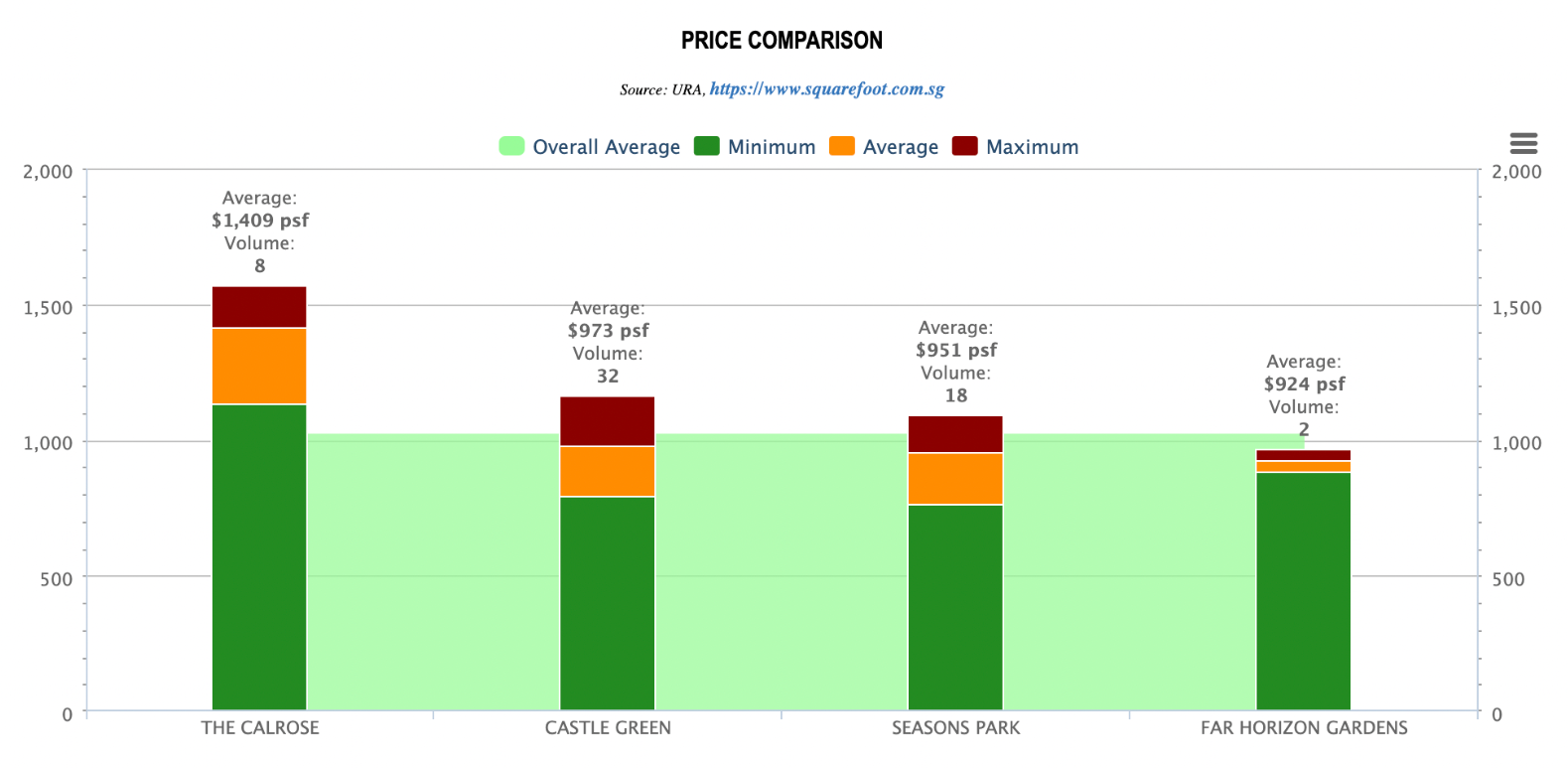

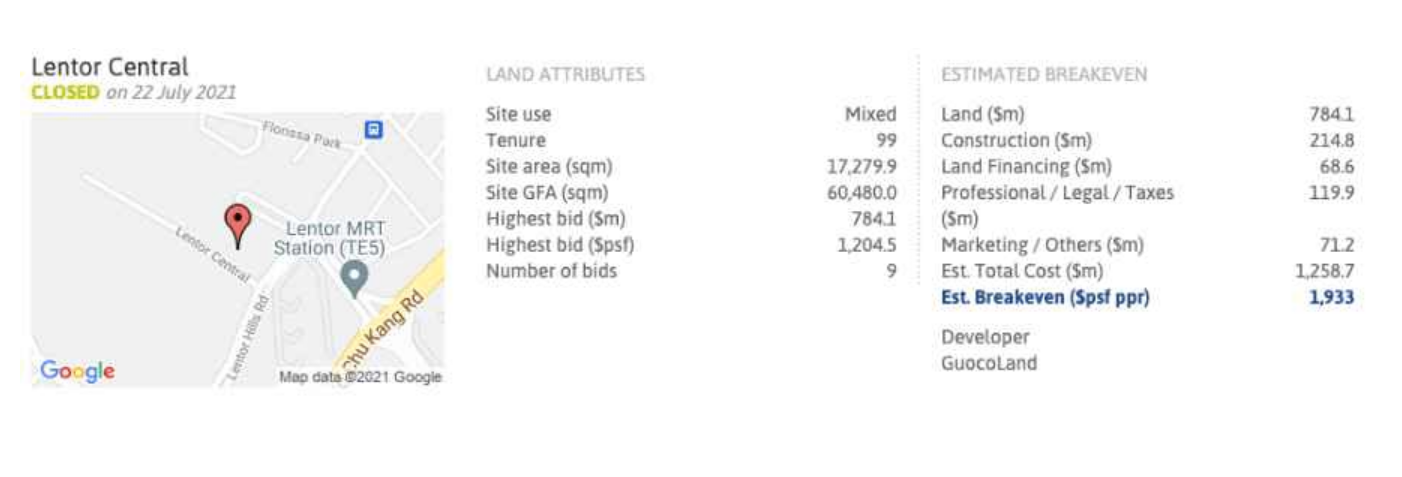

As per EdgeProp's report, construction expenses amount to approximately $214.8 million, representing 27% of the land's value. With a projected developer profit margin of 15%, the potential per square foot (psf) is estimated at around $2,000. Additionally, the proximity of the Lentor Central site to the upcoming Lentor MRT station on the Thomson East Coast Line (TEL), slated to commence operations shortly, is clearly evident in the visuals.

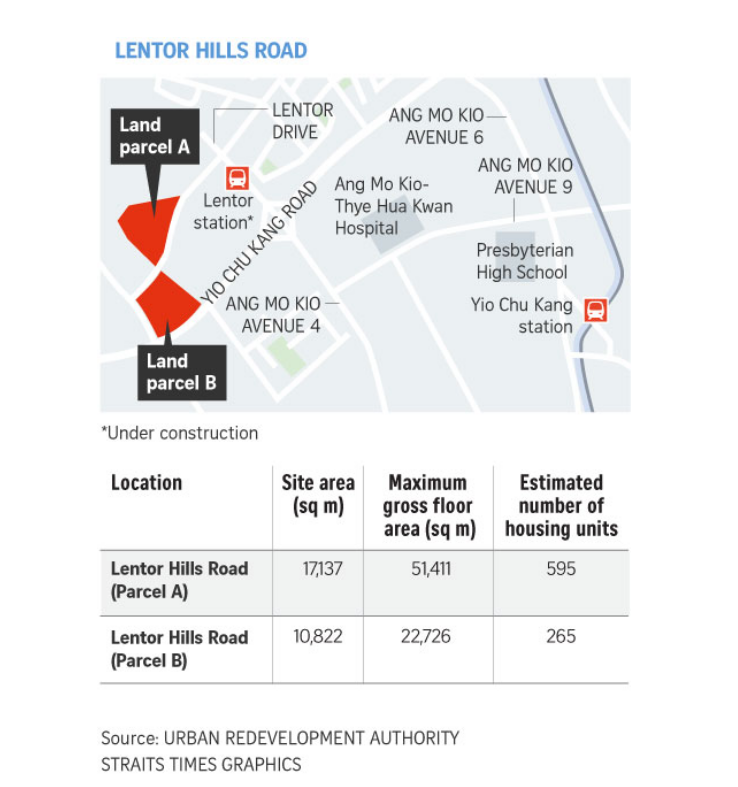

Gain a bird's-eye perspective from Blk 601 to witness the HDB blocks nearest to the new GLS sites. Alongside Lentor Central, URA offers two additional GLS plots, identified as Parcel A and Parcel B. What does this multi-offer approach signify for investors? Purchasing a unit within Guccoland's inaugural project at Lentor Central proves strategic for investors seeking either investment opportunities or a homestay option.

Typically, subsequent GLS plots, namely Parcel A and Parcel B, command higher prices than the initial Lentor Central plot. Opting for early involvement in the project affords buyers a first-mover advantage. However, absolute certainty in outcomes remains elusive, as future outcomes cannot be definitively predicted. Success or failure is subjective, underscoring the importance of investors managing their preferred risk levels.

Do you see the potential of the Lentor Area? It is an upcoming area. The main question on every homeowner of investor's mind is how much will each unit sell?

We will never know how much each unit will sell or whether it will go up or down. We do not have a crystal ball. All we can say that we need to take the risk and go with our gut and make the investment.

Key Takeaways - The Litmus Test

Lentor Central currently stands as an underdeveloped area, yet its potential is evidently recognized by Guccoland and eight other bidders. While clarity may elude us, developers see promise in the land.

The litmus test lies in the forthcoming sale launch by the developer and the government's offering of GLS Parcel A and Parcel B, especially following the government's recent cooling measures in December 2021.

Our assessment suggests that despite the high prices and cooling measures, the sale of Lentor Central condo units is poised for success.