Trend is your Friend: Market Update - 1Q 2022

The question on every investors mind is - Is the market re calibrating? If yes, should you wait or should you take the opportunity to enter the market if you have been on the sidelines.

As can be seen during the Covid-19 pandemic era of the last 2 years, the Market Trend is still above the support trend line as seen in yellow and has only dipped twice, but the trend is heading northwards. From this trend line, we know there is support for the property prices.

As investors already know, Singapore provides a safe heaven for investment as many MNC stationed their regional and even global HQ and regional R&D centers in the small city state due to its strong and stable Political System via a Strong Government. On the Corporate side, leaders express confidence in the strong corporate governance and reliable legal framework compared.

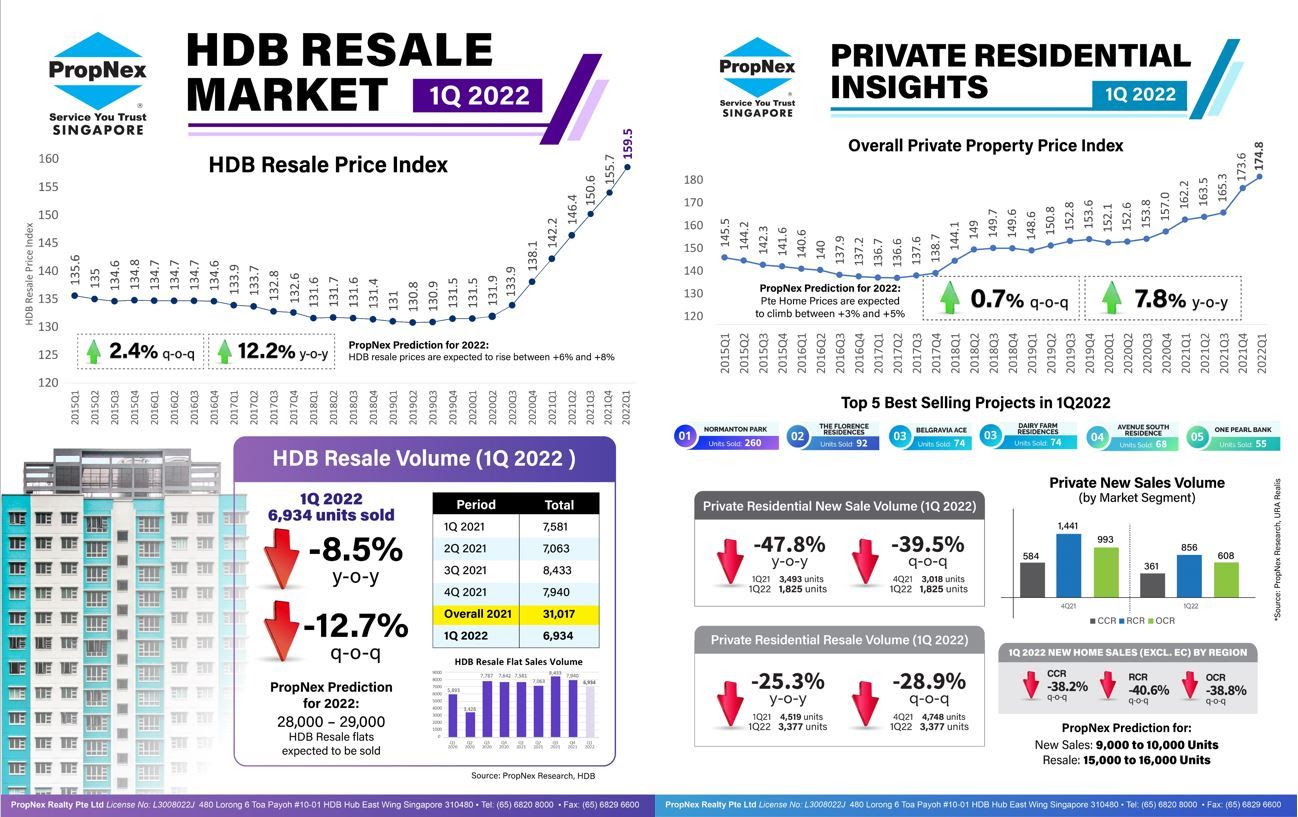

✨ In Q1 2022, both private residential and HDB resale flat prices posted slower growth in Q1 2022, as the impact of the new cooling measures – such as hikes in ABSD rates and tightening of the TDSR threshold – dampened sentiment and limited new launches and the seasonal lull reined in sales volumes. Private residential prices inched up by 0.7% QOQ, a slowdown from the previous quarter's 5% QOQ. Developers sold 1,825 new private homes (ex. ECs) in Q1 2022, while 3,377 residential resale properties were transacted.

In Q1 2022, HDB resale prices continued to rise at a slower pace, increasing by 2.4% QOQ – this is the slowest quarterly growth since Q3 2020 where resale values climbed by 1.5% QOQ. Meanwhile, the HDB resale market sold 6,934 homes during the quarter, representing a 12.7% QOQ decline from the 7,940 flats transacted in Q4 2021.