PROPERTY PRICES may decline, but reconsider that thought

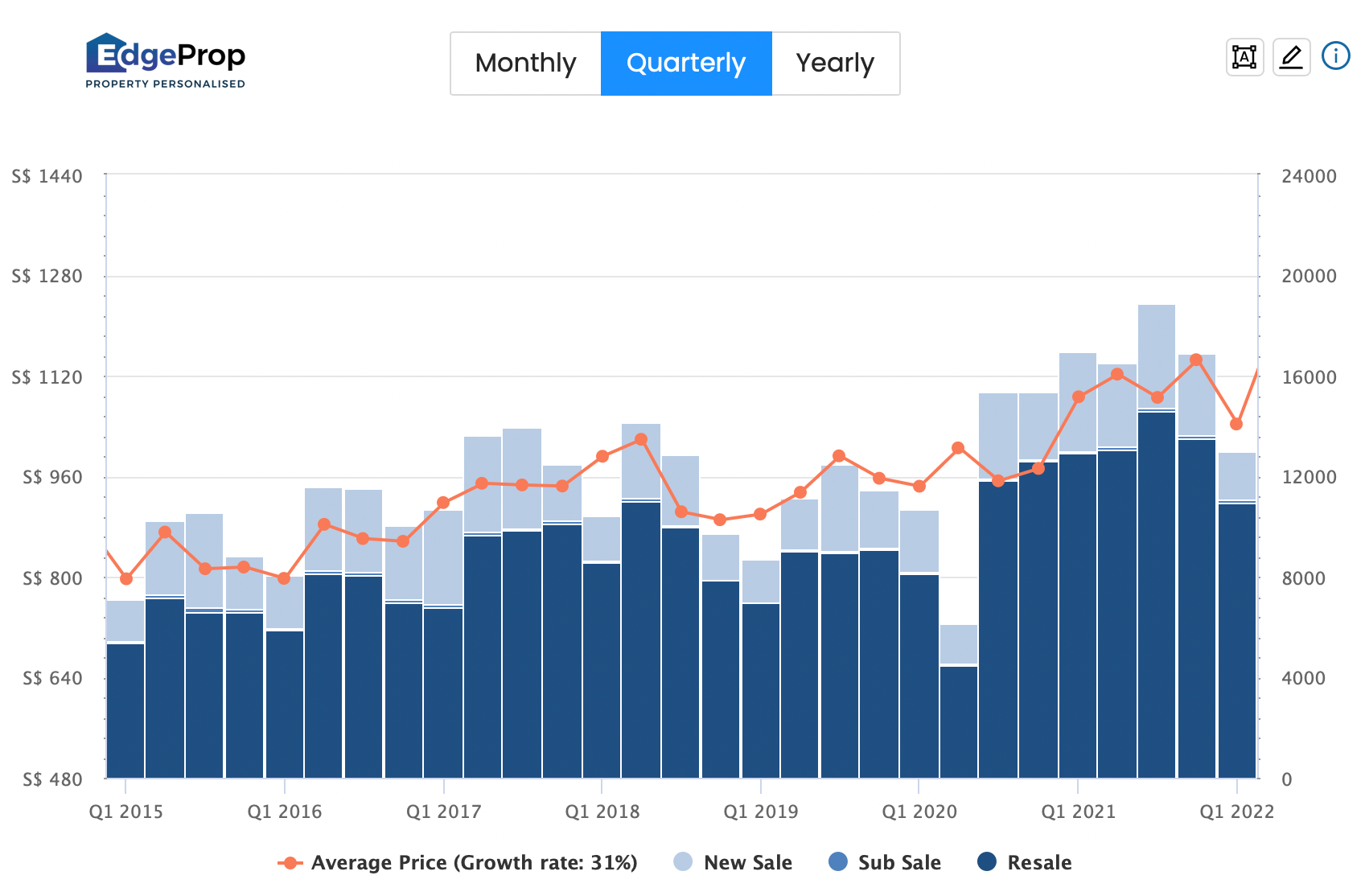

Wealthy families are increasingly opting to invest in Singapore, whether by acquiring properties for residency or establishing offices like Family Home Offices. Recent analyses indicate that the influx of ultra-rich individuals is unlikely to depress property prices, as evidenced by the consistent and upward trend in condominium prices from 2015 to 2022.

Moreover, reports highlight a notable increase in the number of High Net Worth Individuals (HNWIs), which has reached 1.41 million, representing about 20% of Singapore's population. This trend reflects growing confidence among affluent individuals in Singapore's governance and its favorable environment for wealth accumulation.

The presence of HNWIs settling in Singapore generates various economic advantages. Their investments in personal properties also boost demand for related services such as electricians, plumbers, and landscapers, contributing to overall economic growth.

Despite challenges like the COVID-19 pandemic, which significantly affected many sectors including hospitality and entertainment, Singapore's property market has demonstrated resilience. However, recent geopolitical issues such as the Russia-Ukraine conflict and expected interest rate hikes by the Federal Reserve may indicate a potential slowdown in the property sector.

While these factors provide insights into possible future trends, uncertainty remains. A chart illustrating the average price growth rate of properties since 2015 shows the market's resilience amid various economic challenges; however, whether this trend will continue or decline remains to be seen.

Why is it beneficial when High Net Worth Individuals (HNWIs) choose to settle in Singapore? Their property purchases, particularly for personal residences, lead to increased spending on various services. For example, if a newly acquired home experiences electrical issues, the owner is likely to hire technicians for repairs. This pattern extends to other service sectors, including plumbing, pool maintenance, landscaping, and more. As HNWIs invest in Singaporean properties, they significantly contribute to economic growth.

Despite the economic hurdles posed by the COVID-19 pandemic in 2020 and 2021—during which many businesses in customer-facing sectors like food and beverage, entertainment, beauty, and fitness struggled—the Singapore property market demonstrated remarkable resilience. Even with potential slowdowns indicated by global events such as the Russia-Ukraine conflict and multiple interest rate hikes by the Federal Reserve in 2022 to combat inflation, the property market has continued to perform exceptionally well, suggesting its ongoing strength.

In summary, the influx of HNWIs not only boosts demand for real estate but also stimulates various service industries, fostering overall economic expansion in Singapore.